Why Carrying Out a Financial Debt Administration Plan Is Vital for Long-Term Financial Health and Comfort

In today's intricate financial landscape, the implementation of a Financial obligation Administration Plan (DMP) arises as a crucial strategy for achieving long-lasting economic security and satisfaction. By simplifying financial obligation obligations into a convenient format, individuals not just relieve the burdens of several lenders however likewise cultivate crucial budgeting abilities. This positive method prepares for financial strength, yet many continue to be not aware of the details steps and benefits that accompany a DMP. Understanding these elements can essentially change one's monetary trajectory, raising the question of just how one may start this necessary trip - also found here.

Comprehending Financial Debt Monitoring Plans

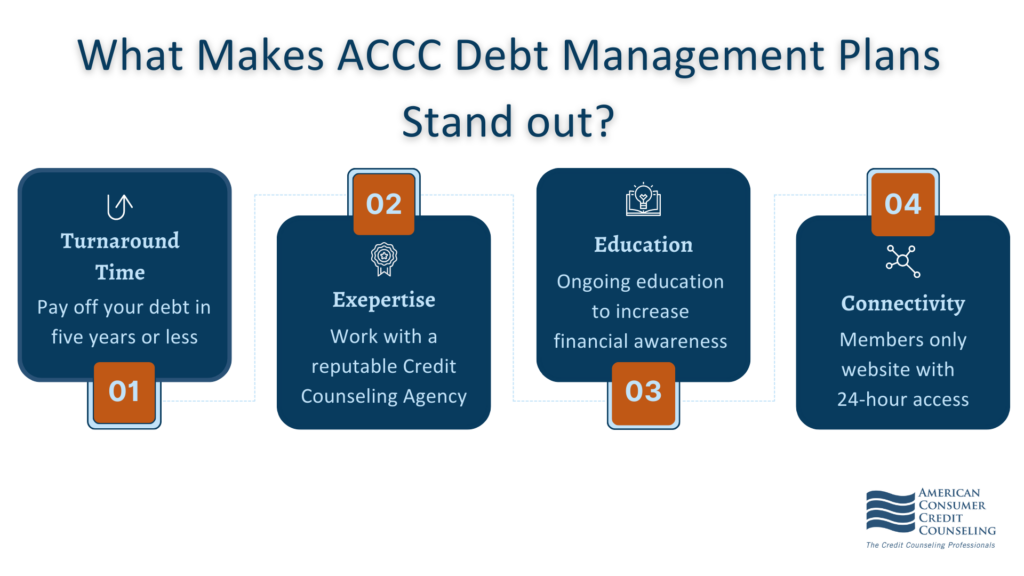

A considerable variety of people deal with managing their financial obligations, making Financial debt Monitoring Plans (DMPs) a vital source for monetary healing. A DMP is a structured repayment plan that allows people to consolidate their debts into a solitary monthly settlement, commonly at minimized rate of interest. Generally facilitated by credit score counseling companies, these strategies intend to streamline the financial obligation repayment process and help individuals reclaim control over their economic situations.

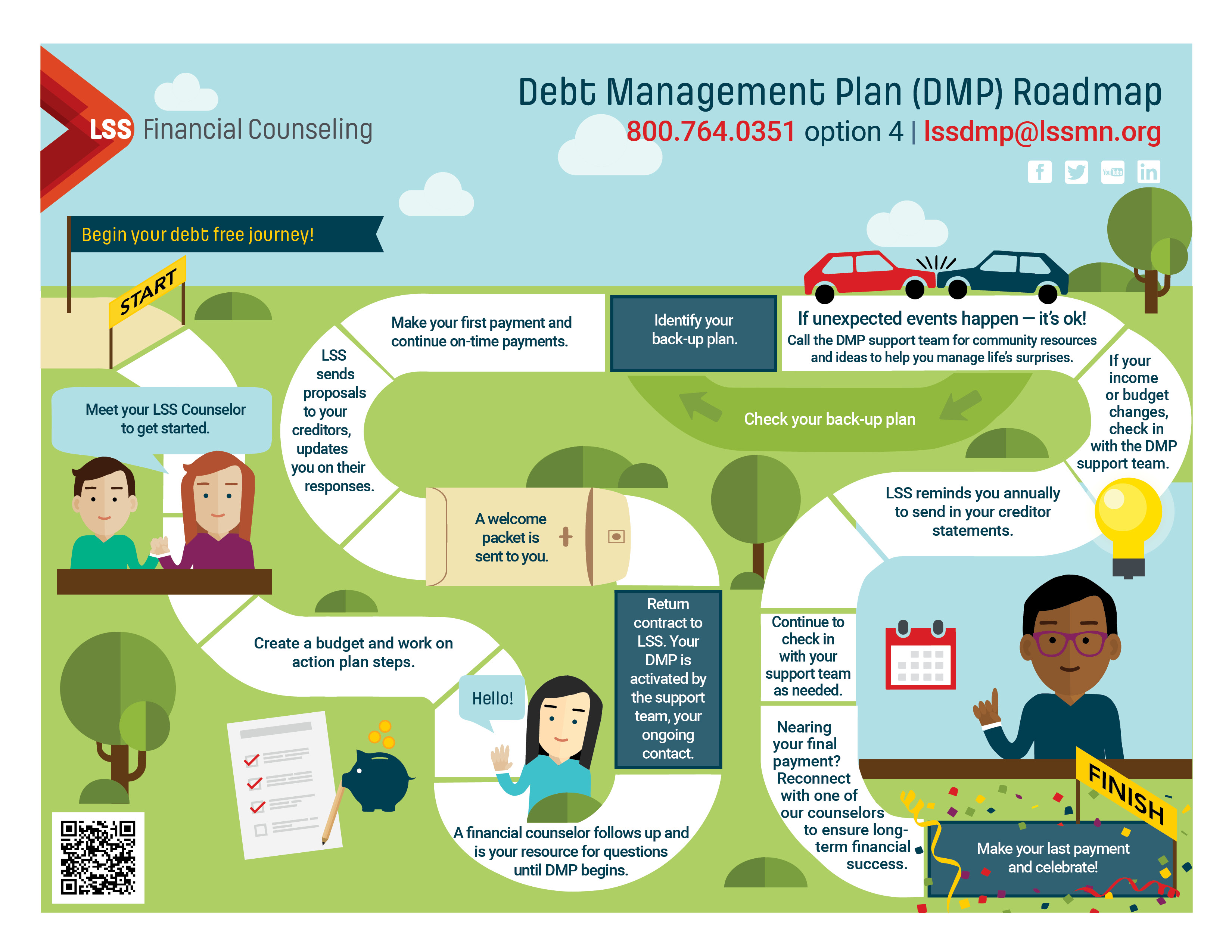

The process starts with a thorough analysis of the person's monetary circumstances, including earnings, costs, and overall financial debt. Based on this assessment, a counselor develops a tailored DMP that outlines just how much the individual will certainly pay monthly and the anticipated period of the plan. Creditors typically consent to the proposed terms, which might include reduced interest rates or forgoed fees, making repayment much more manageable.

Benefits of a DMP

While navigating the complexities of debt settlement can be overwhelming, a Debt Monitoring Strategy (DMP) uses many advantages that can substantially alleviate this worry. Among the key benefits of a DMP is the combination of several financial debts into a solitary month-to-month repayment, simplifying economic administration and lowering the possibility of missed repayments - also found here. This streamlined method can result in lower rate of interest worked out by credit report therapy firms, eventually reducing the complete expense of debt over time

In addition, effectively finishing a DMP can positively impact one's credit report score, as constant payments show financial duty. On the whole, the benefits of a DMP prolong past plain financial obligation reduction, cultivating a feeling of empowerment, economic stability, and long-term assurance for those committed to boosting their economic wellness.

Actions to Implement a DMP

Carrying Out a Financial Debt Administration Strategy (DMP) includes numerous key steps that make sure a smooth shift into an organized payment procedure. The very first step is to examine your economic scenario by gathering details on all financial obligations, revenue, and costs. This thorough view allows for much better preparation.

Following, it's suggested to look for help from a reliable credit rating therapy firm. These specialists can aid you recognize your alternatives and overview you in producing a tailored DMP that matches your have a peek at these guys financial requirements. They will certainly negotiate with your creditors to reduced interest prices and establish a read the full info here workable repayment routine. when you have actually chosen an agency.

After reaching an arrangement, you will certainly make a solitary monthly repayment to the agency, which will then distribute the funds to your financial institutions. It's vital to devote to this layaway plan and prevent accruing additional financial debt throughout the payment period.

Conquering Common Obstacles

Navigating a Financial Debt Monitoring Plan (DMP) can provide different obstacles that may prevent progression. One of the most usual barriers is the psychological strain related to handling financial obligation. The stress and anxiety and stress can lead some people to abandon their plans too soon. To counter this, it's vital to grow an assistance system, whether through close friends, household, or professional counseling, to keep inspiration and responsibility.

Additionally, some individuals may have a hard time with the technique required to follow a stringent budget. Producing a realistic budget plan that makes up both essential expenditures and optional spending can assist maintain conformity with the DMP. Regularly evaluating and changing the spending plan as required is also crucial.

Finally, there may be a temptation to sustain brand-new financial obligation, which can severely undermine development - also found here. Establishing clear economic goals and understanding the long-lasting advantages of the DMP can help preserve emphasis and discourage impulsive costs

Long-Term Financial Strategies

Successfully taking care of a Financial obligation Monitoring Plan (DMP) not just involves getting rid of instant difficulties yet also requires a progressive method to monetary wellness. Lasting economic approaches are necessary to ensure that individuals not only alleviate their existing debt however likewise build a steady foundation for future economic wellness.

One of the most important approaches use this link is budgeting. Creating an extensive monthly budget plan permits individuals to track revenue and costs, making sure that they allocate enough funds towards financial obligation settlement while also reserving cash for financial savings and investments. Additionally, establishing an emergency fund can offer a monetary buffer versus unanticipated costs, decreasing the possibility of sustaining new debt.

Spending in monetary education is one more important part. Understanding the dynamics of credit scores, rates of interest, and investment options encourages individuals to make enlightened decisions. Moreover, establishing clear financial goals-- such as saving for retirement or acquiring a home-- can provide motivation and direction.

Conclusion

In verdict, applying a Financial debt Management Plan is essential for cultivating lasting financial wellness and attaining peace of mind. By enhancing financial obligation repayment, urging self-displined budgeting, and advertising monetary education and learning, a DMP equips individuals to reclaim control over their finances.

In today's complicated economic landscape, the implementation of a Financial obligation Management Plan (DMP) emerges as an important approach for achieving long-lasting economic stability and peace of mind.A considerable number of individuals struggle with handling their financial obligations, making Financial obligation Administration Plans (DMPs) an important resource for financial recovery.While browsing the intricacies of financial obligation settlement can be overwhelming, a Financial debt Management Plan (DMP) uses numerous advantages that can significantly reduce this concern. One of the main advantages of a DMP is the debt consolidation of numerous financial debts into a single month-to-month payment, simplifying economic monitoring and reducing the likelihood of missed repayments. By enhancing debt repayment, motivating disciplined budgeting, and advertising financial education, a DMP equips people to reclaim control over their finances.